Mastering 21st Century

Enterprise Risk Management

The Future of ERM - Book 1 - Executive's Guide

“Mastering 21st century Enterprise Risk Management” is an Executive’s Guide for transforming ERM. This book provides executives the foundations required to implement AI-based Risk Management. Artificial intelligence based risk management is the Future of ERM. As such, Good Governance, Ethics, Strategic Management, and Risk based Auditing, are all necessary perquisites for tackling the two-edged sword that is AI based Risk Management.

Combining the best of ISO31000 and COSO-ERM, you can transform ERM from an overhead to a value-adding driver of growth. This will deliver real bottom-line returns. It covers how to link risk to strategy, using Scenario Analysis, and use risk registers for risk based decision-making. Also, by using Bayesian modelling and aggregating risks, it allows organizations to manage the uncertainty in strategic objectives. Thereby, fulfilling the primary directive of ISO 31000.

In the post COVID business environment, managing uncertainty (risk) is not just a management technique. It’s a survival skill. This book presents proven strategies and practices developed working with some of Australia’s leading organizations. These include the Australian Dept. of Defence, Victorian Infectious Diseases Labs, Serco, and Motorola.

Understanding the principles of Bayesian statistics, causal mapping, and threat management, puts executives in the driver’s seat. It also sets a solid platform to manage volatility and exploit the vast potential inherent in the full range of artificial intelligence and disruptive technologies available today.

Author: Gregory M Carroll

Mastering 21st Century Enterprise Risk Management

Table of Contents

Chapter 1

Firing Failed Risk Practices

- Brexit and the failure of ERM

- Past Failures

- Ford Australia’s closure

- QANTAS $3 Billon Loss in 2014

- Why Risk Management is broken

- Why Risk Management is Failing

- Compliance Failures from ANZ to VW

- Learning from the Past

- The Risk Outlook.

- Rethinking Risk Management.

- ERM system weaknesses.

- Takeaways from Past Failures

- Changing our view of Risk Management

- Understanding Risk

- Risk Management Frameworks

- ISO 31000

- COSO ERM

- Which Framework to use?

- Complexity & Uncertainty

- Chaos Theory and causes of Risk

- Complexity & Systemic Collapse

- Lessons from COVID-19 pandemic

Chapter 2

Current State of Risk Management

Chapter 3

Firing Failed Risk Practices

- Governance

- What is corporate governance?

- A New Approach to Governance

- How Company Directors should manage THEIR Exposure

- Leadership

- Napoleon’s Lessons in Strategic Management

- Risk Management Champion

- Role of the modern Risk Manager

- Millennials vs Risk Management

- Risk Culture

- The “Risk Culture” Myth

- Hitler Diaries Case Study

- Ethics and Values

- Citibank vs Berkshire Hathaway – The Power of Ethics

- Social Responsibility the New Black

- Prejudice & Abuse in Youth Detention

- Strategic Risk

- Proactive vs Re-Active Risk Management

- Nature of Risk

- Context and Objectives

- What is Context?

- Defining Objectives

- Managing Objectives

- Apple vs Enron: Commercial Sustainability

- Risk Appetite

- Risk Appetite is Risk Tolerance

- Risk Appetite not Anorexia

- Integrating Risk Appetite into an Organisation

- Strategic Thinking

- Strategic Management

- Game Theory

- Strategic Decision-making

- Organisational Resilience

Chapter 4

Strategy and Objectives

Chapter 5

The Risk Process

- Risk Identification

- How to Identify Corporate Risks

- The Delphi Method

- Understanding Emerging Risks

- The Black Swan Syndrome

- Specifying Risks

- Risk Analysis

- Quantitative Risk Analysis

- Using Scenario Analysis

- Causal mapping

- How to Analyse Risk

- Risk Evaluation

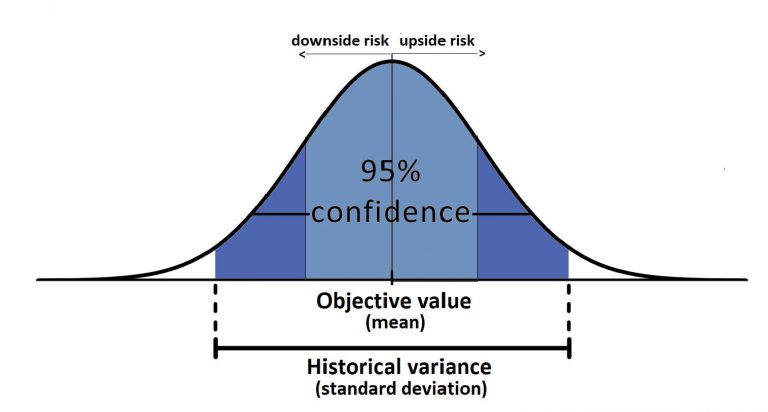

- Measuring Risk Probabilistically

- Bayesian Modelling

- How to calculate Risk Exposure

- Measuring Risk – Value at Risk

- Risk Treatment

- Causal DMZ

- Horizon Scanning & KRI Triggers

- Incident Management

- Risk Aggregation

- Risk Network Mapping

- Why aggregate risk

- Risk-Based Decision-making

- True Business Intelligence

- Informed Decision-making

- The Decision-making Process

- Audit and Review

- Attributes of a Strong Compliance Structure

- Visibility and Accountability

- Improving Audit Management

- Managing Change

- Digital Transformation

- Improvement and Innovation

- Misunderstanding Innovation

Chapter 6

Review and Improvement

Chapter 7

Implementation Secrets

- Queensland Health $billion fiasco

- Planning

- Why use ERM software

- Secrets to successful risk management

- Selecting ERM software

- How to select the right software

- Implementation

- Where to start Enterprise Risk Management (ERM)

- Getting management started

- Getting software implementation right

Mastering 21st Century Enterprise Risk Management Reviews

“Must Reading!”

“Comprehensive with lots of items not included in other such books”

-

How to Aggregate Risk – Part 1February 22, 2022/1 Comment

How to Aggregate Risk – Part 1February 22, 2022/1 Comment -

Risk Intelligence Critical Book ReviewsNovember 10, 2021/

Risk Intelligence Critical Book ReviewsNovember 10, 2021/ -

Risk Intelligence: AI in Risk ManagementAugust 5, 2021/

Risk Intelligence: AI in Risk ManagementAugust 5, 2021/